FIGI: BBG00BGL9626 | ISIN: US5398301094 | Symbol: LMT | CUSIP: 539830109

Discover everything you need to know about Lockheed Martin Corporation (LMT) stock, one of the most prominent aerospace and defense companies in the world. Learn the current market value of the company and its shares, where to purchase its securities, the key factors influencing its stock price, dividend history, and much more. Explore our interactive Lockheed Martin stock chart to track prices on the NYSE in real-time or review historical trends for all time periods. Stay informed and make data-driven investment decisions with a complete view of LMT’s market performance and financial strength.

Our Lockheed Martin Corporation (LMT) stock live chart is a simple, lightweight, and powerful tool designed for seamless online technical analysis. No downloads or extra software are required—just open the chart and start analyzing instantly. For advanced traders, the chart offers over 100 analysis tools and more than 80 technical indicators that can be added in just two clicks. Track real-time price movements, identify trends, and explore endless possibilities to optimize your trading strategy with ease.

Technical Analysis Lockheed Martin (LMT) Stock

The Lockheed Martin Corporation (LMT) Stocks Technical Analysis widget is a modern, user-friendly tool that provides instant ratings based on technical indicator data. Designed in the form of a speedometer, it allows you to quickly grasp the results of a comprehensive technical analysis without manually checking multiple indicators. All ratings are updated in real-time, ensuring accurate and current insights. The widget utilizes a wide range of technical indicators including Relative Strength Index (RSI), Stochastic, Commodity Channel Index (CCI), Average Directional Index (ADX), Awesome Oscillator, Momentum, MACD, Stochastic RSI, Williams %R, Bull Bear Power, Ultimate Oscillator, Exponential Moving Average (EMA), Simple Moving Average (SMA), Ichimoku Cloud Base Line, Volume Weighted Moving Average (VWMA), and Hull Moving Average to provide a complete market overview.

Fundamental Analysis Lockheed Martin (LMT) Stock

The widget also provides comprehensive fundamental data that offers a deeper understanding of Lockheed Martin Corporation’s current financial health beyond simple stock prices. Key fundamentals include Market Capitalization, Enterprise Value, Balance Sheet, Operating Metrics, Price History, Margins, Income Statement, Dividends, and many other critical data points, giving investors a full picture of the company’s performance and value.

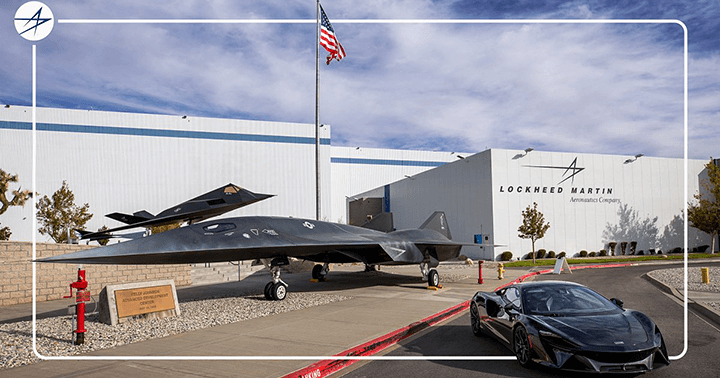

Lockheed Martin Stock ✈️

The story of Lockheed Martin Corporation begins in 1912 when Allan and Malcolm Lougheed founded the Alco Hydro-Aeroplane Company, later renamed the Loughead Aircraft Manufacturing Company. This early venture laid the foundation for one of the world’s leading aerospace and defense corporations.

Fourteen years later, Allan Lougheed established the Lockheed Aircraft Company. However, just three years after its founding, he sold the company to the Detroit Aircraft Corporation, marking the first major ownership change in its history.

During the Great Depression, the company faced severe financial challenges and was declared bankrupt. It was put up for auction, and Allan Lougheed intended to buy back his company. Despite raising $50,000 for the acquisition, he considered the amount insufficient for such a large transaction. Ultimately, a group of investors led by brothers Robert and Courtlandt Gross, along with Walter Varney, successfully purchased the company for only $40,000.

In 1995, Lockheed Corporation merged with Martin Marietta, a company founded in 1961 known for its pioneering work in aerospace and electronics. This merger created Lockheed Martin Corporation, a global leader in defense, aerospace, and advanced technology.

During the merger, former Lockheed stockholders received 1.63 common stock of the new entity for each Lockheed stock they held, while Martin Marietta stockholders received 1 common stock of Lockheed Martin for every Martin Marietta stock. Following the merger, Lockheed Martin stock quickly appeared on the market, attracting significant investor interest due to the combined strength of both companies.

Today, Lockheed Martin Corporation stock represents ownership in a major U.S. defense contractor engaged in the development, design, and production of cutting-edge aircraft, electronics, telecommunications systems, space technologies, and integrated defense solutions. The corporation remains one of the largest and most trusted contractors of the U.S. government, making its stock a compelling option for investors seeking exposure to the defense and aerospace sectors.

The strong demand for Lockheed Martin Corporation stock is largely driven by the U.S. Department of Defense, which is the company’s largest customer and buyer of its advanced defense products. This consistent government demand provides a stable revenue stream and positions the company as a cornerstone of the U.S. defense industry.

Beyond the Department of Defense, Lockheed Martin also supplies a wide range of equipment and technology to other U.S. government agencies, further strengthening its market position and making its stock highly attractive to investors looking for stability and long-term growth in the defense sector.

Lockheed Martin Corporation stock also benefits from strong international demand, as the company sells advanced aircraft, air defense systems, missile defense solutions, and other military equipment to foreign governments seeking top-tier American technology.

The corporation is globally recognized for producing iconic aircraft, including the F-22A Raptor multirole fighter, F-16 Fighting Falcon light fighter, C-130 Hercules military transport, F-35 Lightning II multirole fighter-bomber, and P-3 Orion coastal patrol aircraft. These products reinforce Lockheed Martin’s reputation for innovation and reliability in defense aviation.

Beyond aircraft, Lockheed Martin maintains a stable and influential presence in the air defense and missile defense market. Analysts consistently rank the company as one of the largest and most influential manufacturers within the global military-industrial complex.

Today, Lockheed Martin nearly dominates the fifth-generation fighter market in NATO countries, solidifying its strategic role in international defense and making its stock a compelling option for investors seeking exposure to the aerospace and defense sector.

Following the 2017 acquisition of Sikorsky Aircraft Corporation, Lockheed Martin significantly expanded its aerospace portfolio, actively producing both fixed-wing aircraft and advanced helicopters. This strategic move strengthened the company’s market presence and enhanced the appeal of Lockheed Martin stock for investors interested in comprehensive exposure to the aviation and defense sectors.

Lockheed Martin Stock Indices 📈🌍

The Lockheed Martin Corporation (LMT) stock is a cornerstone of the defense and aerospace sector, included in numerous key stock indices worldwide. Its presence in these indices reflects the company’s financial stability, market influence, and attractiveness to investors.

- 🚀 S&P 500 – a major benchmark of U.S. large-cap stocks

- 🛡️ Dow Jones US (DJ US) – tracks top U.S. companies across sectors

- 💹 S&P 100 – includes 100 leading U.S. stocks with strong market presence

- 🏛️ NYSE Composite – all common stocks listed on the New York Stock Exchange

- 📊 DJ Value – measures performance of value-oriented U.S. stocks

- 🛫 S&P 500 Industrials – covers top industrial sector companies

- 🏆 DJ Sector Titans Composite – tracks leading sector giants

- 🌟 NYSE TOP US 100 – top 100 U.S. stocks by market cap

- 🪖 DJ Defense – focuses on major defense industry corporations

- ⚙️ S&P Composite 1500 Industrials – industrial stocks from S&P 1500

- 💼 DJ Large-Cap – tracks large-cap U.S. companies

- 🏢 ARCA Institutional – institutional stock performance index

- ✈️ DJ Aerospace & Defense – aerospace and defense leaders

- 🏗️ Dow Jones Industrial Goods & Services – key industrial goods & services

- 🔹 Russell 1000 Index – large-cap U.S. equities

- 🌐 MSCI USA Index – represents U.S. equity market for global investors

Being included in these prestigious indices underlines Lockheed Martin stock as a high-profile investment, highlighting its reliability, strong fundamentals, and strategic importance in the defense and aerospace markets.

Where to Buy Lockheed Martin Stock 🏦

The Lockheed Martin Corporation (LMT) stock is traded on several major stock exchanges worldwide, providing investors with multiple options to buy and track this leading aerospace and defense stock. Key exchanges include:

- 🇺🇸 New York Stock Exchange (NYSE) – primary trading venue for LMT stock in the United States

- 🇬🇧 London Stock Exchange (LSE) – international access for UK investors

- 🇩🇪 Frankfurt Stock Exchange (FSE) – trading for German and European investors

- 🇨🇭 SIX Swiss Exchange – Swiss trading platform for global investors

- 🇲🇽 Mexican Stock Exchange (BMV) – access for Latin American investors

- 🇦🇹 Vienna Stock Exchange (WBAG) – Austrian market

- 🇦🇷 Buenos Aires Stock Exchange (BCBA) – Argentine trading

- 🇧🇷 BM&FBOVESPA (B3) – Brazilian market access

Being listed on these prominent exchanges makes Lockheed Martin stock highly accessible to international investors, enhancing liquidity and global trading opportunities. This wide availability underscores the company’s status as a major player in the defense and aerospace sectors and boosts its visibility in worldwide financial markets.

Lockheed Martin Subsidiaries & Divisions 🛡️

Lockheed Martin Corporation has a diverse portfolio of subsidiaries and divisions that extend the company’s reach across the globe and support its leading position in the defense and aerospace industries. These subsidiaries represent the company’s interests internationally and engage in scientific research, as well as the development of military and civilian equipment.

Key Subsidiaries 🌍

- 🇦🇺 Lockheed Martin Australia – overseeing operations and projects in Australia

- 🇨🇦 Lockheed Martin Canada – Canadian subsidiary managing regional programs

- 🇬🇧 Lockheed Martin United Kingdom – handling UK operations and technological development

These subsidiaries not only represent Lockheed Martin globally but also contribute to research, innovation, and the development of critical components and assemblies for both military and civilian applications.

Main Divisions 🏢

- ✈️ Aeronautics – develops, produces, modernizes, and repairs military aircraft such as F-22A, F-16, F-35, C-130, and C-5. This division is a major revenue generator for the corporation.

- 🚀 Space Systems – designs and manufactures rocket and space technologies, satellites, and related systems, including AEHF military satellites, SBIRS missile detection systems, Orion manned spacecraft, Trident 2 missiles, launch vehicle components, and ground control systems.

- 🛰️ Mission Systems & Training – develops automated systems for military units, surface ships, submarines, radar, and other modern equipment. Includes Sikorsky Aircraft Corporation producing military helicopters (UH-60, MH-60, SH-60) and civilian helicopters (S-76, S-92), as well as developing unmanned aerial vehicles.

- 💥 Missiles & Fire Control – focuses on air defense, missile defense systems, tactical missile weapons, and fire control systems.

- 💻 Information Systems & Global Solutions – provides cybersecurity, software development, information services, and global customer support for delivered products.

The extensive network of subsidiaries and divisions allows Lockheed Martin to maintain a strong position in the military-industrial complex and achieve near-monopoly control in certain sectors. Looking forward, the corporation plans to expand its portfolio of advanced defense and aerospace equipment, further strengthening its stock’s investment potential.

Lockheed Martin Dividends 💰

Lockheed Martin Corporation pays consistent quarterly dividends to its shareholders, typically ranging from 1.9% to 3% per annum. These dividends offer an attractive yield, significantly higher than the interest rates on traditional U.S. bank deposits, making LMT stock appealing to investors seeking stable, long-term income without the need to sell their stock holdings.

In addition to its regular dividend payouts, Lockheed Martin has a strong history of dividend growth. The company has consistently increased its dividend over the years, reflecting its stable revenue from government contracts and strong financial position. This pattern of dividend growth makes LMT stock not only a source of current income but also a potential tool for wealth accumulation through reinvested dividends.

For long-term investors, dividend reinvestment can significantly enhance overall returns. Lockheed Martin’s commitment to maintaining and gradually increasing dividend payouts demonstrates its dedication to shareholder value and financial stability in the defense and aerospace sectors.

Lockheed Martin Major Shareholders 💼

Lockheed Martin Corporation (LMT) has a diverse group of shareholders, with the most significant influence typically coming from holders of large stock blocks. Understanding the major shareholders can provide insights into the stability and governance of the company.

Top Institutional Shareholders 📊

- 🏛️ SSgA Funds Management Inc. – controls 16.48% of LMT stock

- 💼 Capital Research & Management Co. (World Investors) – owns 7.69% of stock

- 📈 The Vanguard Group Inc. – holds 6.95% of shares

- 🟢 BlackRock Fund Advisors – owns 5.20% of stock

- 🌐 Capital Research & Management Co. (Global Investors) – controls 3.01% of stock

- 🏦 Wellington Management Co. LLP – owns 2.70% of shares

- 🌍 Capital Research & Management Co. (International Investors) – controls 1.51% of stock

Other notable shareholders include investment arms of major U.S. banks such as Wells Fargo and Morgan Stanley. While these entities may act as nominal holders, their inclusion reflects the broad institutional interest and confidence in Lockheed Martin stock.

The concentration of LMT stock among these leading institutional investors supports market stability and indicates strong long-term confidence in the corporation’s performance and growth prospects.

What Influences Lockheed Martin Stock Price? 📉

The price of Lockheed Martin Corporation (LMT) stock is influenced by a variety of factors, both domestic and international. One major driver is the level of interest from global investors in the U.S. defense and aerospace markets. The value of LMT stock on American exchanges is often affected by the flow of capital from both U.S. resident investors and international participants.

Another key factor is the company’s creditworthiness. Since Lockheed Martin actively issues debt securities, changes in its credit rating by leading rating agencies can significantly impact stock value. For example, a downgrade could increase debt servicing costs and potentially reduce the company’s profitability, which in turn may affect the stock price.

Financial performance remains one of the most important determinants. Increases in revenue, profit, and other key financial indicators tend to positively influence the price of Lockheed Martin stock. Analysts point out that growing sales of the company’s advanced aerospace, defense, and technological products—ranging from aircraft to missile defense systems—can drive profit growth, making LMT stock more attractive to investors.

Several additional factors can influence the value of Lockheed Martin Corporation (LMT) stock, reflecting both macroeconomic conditions and sector-specific challenges.

- 🌍 Global financial instability – The growing likelihood of a large-scale financial crisis, whether in the U.S. or worldwide, can negatively impact stock prices.

- 🛠️ Product demand fluctuations – A decline in demand for key products, such as the F-35 fighter-bomber, due to operational complexity or technical shortcomings, could reduce revenue and profit.

- 🏦 Interest rate changes – Rising U.S. interest rates set by the Federal Reserve may increase the cost of borrowing for Lockheed Martin. Higher debt servicing costs can significantly reduce profitability and affect overall financial performance.

- ✈️ International competition – While Lockheed Martin produces the F-35 and modernizes the F-22, production and sale of similar fifth-generation aircraft by Russian and Chinese companies may lower global demand for American-made aviation products. Reduced sales in international markets could negatively impact revenue, profit, and ultimately the stock price.

Investors should consider these factors alongside the company’s strong fundamentals, global contracts, and technological leadership when analyzing Lockheed Martin stock for potential investment.

Factors Influencing Lockheed Martin Stock Price 📡

The evolution of modern aviation and the production of fifth-generation fighter jets by Russian and Chinese defense enterprises, along with increased development of missile weaponry, may boost demand for advanced missile defense systems such as THAAD and Aegis. Rising demand for these high-value military products can positively impact Lockheed Martin stock prices.

Experts also note that the U.S. Department of Defense budget plays a critical role in determining the stock price. Particular attention should be paid to allocations for new purchases and modernization of military aircraft and missile defense systems, as the Pentagon is a major customer for Lockheed Martin. Decisions on significant defense spending can lead to increased trading activity and potentially higher stock valuations.

Investors who closely monitor news on the American stock market, corporate announcements, and key market-moving factors can often predict optimal times to buy or sell Lockheed Martin shares with greater accuracy.

Currently, the majority of the company’s revenue and profit comes from the sale of military equipment to the U.S. Armed Forces and defense departments worldwide. Geopolitical tensions and the risk of military conflicts can drive demand for Lockheed Martin’s products, supporting stock price growth. Conversely, a reduction in conflict risk may lower revenue forecasts and put downward pressure on stock prices.

Lockheed Martin (LMT) FAQ 💡

1. What is Lockheed Martin Corporation?

Lockheed Martin Corporation is a leading American aerospace, defense, and technology company engaged in the design, development, and production of military aircraft, missile defense systems, helicopters, space systems, and advanced technologies. Its shares are traded on the NYSE under the ticker LMT.

2. How can I buy Lockheed Martin stock?

To buy LMT stock, you need a brokerage account with access to the NYSE or other exchanges where LMT is listed. Evaluate fees, account services, and investment options before purchasing.

3. What exchanges trade Lockheed Martin stock?

LMT stock is primarily traded on the New York Stock Exchange (NYSE). It is also accessible via international markets such as the London Stock Exchange, Frankfurt Stock Exchange, SIX Swiss Exchange, Mexican Stock Exchange, Vienna Stock Exchange, Buenos Aires Stock Exchange, and B3 (Brazil).

4. Does Lockheed Martin pay dividends?

Yes, the company pays quarterly dividends ranging from 1.9% to 3% per year. LMT has a history of consistent dividend growth, making it attractive for income-focused investors.

5. Who are the largest shareholders of Lockheed Martin?

Major institutional shareholders include SSgA Funds Management Inc. (16.48%), Capital Research & Management Co. (World Investors 7.69%, Global Investors 3.01%, International Investors 1.51%), The Vanguard Group Inc. (6.95%), BlackRock Fund Advisors (5.20%), and Wellington Management Co. LLP (2.70%).

6. What factors influence LMT stock price?

The stock price is affected by revenue and profit growth, Pentagon and international defense budgets, interest rates, credit ratings, geopolitical tensions, product demand, and competition from other aerospace and defense companies.

7. What are Lockheed Martin’s main subsidiaries?

Key subsidiaries include Lockheed Martin Australia, Lockheed Martin Canada, Lockheed Martin United Kingdom, and the previously acquired Sikorsky Aircraft Corporation. These subsidiaries manage international operations and contribute to research and development of military and civilian equipment.

8. What are Lockheed Martin’s main divisions?

Main divisions are Aeronautics, Space Systems, Mission Systems & Training, Missiles & Fire Control, and Information Systems & Global Solutions. Each division focuses on different areas of aerospace and defense production.

9. Which indices include Lockheed Martin stock?

LMT stock is included in key indices such as S&P 500, Dow Jones US, S&P 100, NYSE Composite, DJ Aerospace & Defense, DJ Defense, S&P Composite 1500 Industrials, and global indices like the MSCI USA Index and Russell 1000.

10. Does Lockheed Martin have international customers?

Yes, the company sells advanced aircraft, missile defense systems, and other military equipment to foreign governments, expanding its global presence beyond the U.S. Department of Defense.

11. How does global defense spending affect LMT stock?

Changes in U.S. and international defense budgets directly impact revenue and profit. Higher spending generally supports stock growth, while reductions may lead to price declines.

12. How does Lockheed Martin handle geopolitical risks?

The company adapts production and marketing strategies to address international competition, emerging threats, and changes in defense priorities, which can influence stock price volatility.

13. Is Lockheed Martin suitable for long-term investors?

Yes, LMT stock is considered a stable long-term investment due to its strong fundamentals, consistent dividends, and dominant position in aerospace and defense markets.

14. Can LMT stock be traded for short-term profit?

Yes, traders can use technical analysis, market news, and geopolitical developments to engage in short-term trading of LMT stock, although it requires careful monitoring of relevant factors.

15. Why invest in Lockheed Martin stock?

Investing in LMT offers exposure to a leading aerospace and defense company with global reach, innovative technologies, strong government contracts, dividend income, and potential for long-term capital appreciation.

Lockheed Martin (LMT) Profit Targets

Lockheed Martin (LMT) is showing strong upward momentum, and the stock could continue to rise if certain key technical levels are broken. Here are the updated profit targets for LMT:

– TP1: $505 (Psychological and technical breakout level)

– TP2: $535 (Momentum target driven by strong market performance)

– TP3: $560+ (Extension if global risk continues to rise, increasing demand for defense stocks)

Lockheed Martin remains well-positioned to capitalize on the growing global security concerns and defense spending, with a solid foundation in both government and commercial contracts. As market conditions evolve, the stock could see significant upside potential.