The S&P 500 Index stands as the definitive benchmark for the U.S. equity market, representing 500 of the most influential large-cap companies. Beyond being a market indicator, it is a hub for high-volume trading strategies and institutional investment. Its futures contracts, traded on the CME under the ticker ES, offer unparalleled liquidity for global investors. By tracking real-time market volatility, traders use the S&P 500 to refine portfolio diversification and execute precision technical analysis. Whether you are monitoring economic health or seeking high-liquid assets, it remains the gold standard for modern financial markets.

Utilize our S&P 500 Index Futures Live Chart – a high-performance, web-based terminal designed for sophisticated market analysis. This platform integrates over 100 professional charting tools and 80+ technical indicators, providing the same depth as premium trading software without the need for downloads. Optimized for low-latency data, it allows you to visualize market trends and execute data-driven strategies instantly. Whether you are performing intraday trading research or long-term investment analysis, our interface delivers the precision and speed required to navigate the S&P 500 futures market effectively.

Technical Analysis S&P 500 Index Futures

Our S&P 500 Index Futures Technical Analysis widget is an advanced analytical engine that delivers real-time trading signals based on high-precision indicators. The system supports multiple timeframes, from 1-minute intraday intervals to daily views, allowing you to adapt to scalping, swing trading, or long-term market forecasting. By aggregating data from a comprehensive suite of technical indicators like RSI and MACD, it helps you identify critical support and resistance levels. This flexibility ensures your execution strategy is perfectly aligned with current market volatility and broader economic cycles.

| Trading Style | Timeframe | Primary Objective |

|---|---|---|

| Scalping | 1m – 5m | Capturing rapid price movements and high-frequency volatility. |

| Day Trading | 15m – 1h | Executing intraday positions based on technical trend reversals. |

| Swing Trading | 4h – Daily | Identifying mid-term price action and multi-day market cycles. |

| Long-term Investing | Weekly / Monthly | Assessing overall economic health and fundamental S&P 500 trends. |

About the S&P 500 Index

Created by Standard & Poor’s and first published on March 4, 1957, the S&P 500 is now part of the S&P Dow Jones U.S. family of indices. Widely regarded as a barometer of the U.S. economy, it is also considered a leading indicator that reflects trends in American GDP. Although it was introduced decades after the Dow Jones Industrial Average (DJIA, 1896), the S&P 500 has become the primary benchmark for the U.S. stock market.

Unlike a simple average, Standard & Poor’s assigns a specific weight to each company in the S&P 500 based on its free-float market capitalization — the number of shares actively available for trading. This means that even if a company has the largest overall market cap, it might not have the highest weight in the index.

Currently, the combined market capitalization of all S&P 500 companies exceeds $23 trillion, representing about 70% of the total U.S. stock market value. This vast coverage makes the S&P 500 a crucial gauge of the American economy and equity market health.

Futures contracts on the S&P 500 stock index are available through the Chicago Mercantile Exchange (CME) on the GLOBEX electronic trading platform. These futures can be traded continuously from Monday to Friday, with only a brief daily pause of one hour between 00:00 and 01:00, during which index data is recalculated and updated. This near 24/5 availability offers traders ample opportunity to respond to market developments in real time.

Interestingly, despite its name, the S&P 500 index actually includes 505 stocks representing exactly 500 companies. These companies span a broad range of economic sectors—from healthcare to industrials—making the index a comprehensive tool to gauge the overall health and performance of the American economy.

What Stocks Are Included in the S&P 500? 📊🏢

The S&P 500 index features companies from a diverse range of economic sectors. These are categorized into 11 main sectors according to the Global Industry Classification Standard (GICS), including:

- Information Technology 💻

- Healthcare 🏥

- Finance 💰

- Energy ⚡

- Industrial Goods 🏭

- Consumer Staples 🛒

- Consumer Discretionary 🛍️

- Utilities 🔌

- Telecommunications 📡

- Real Estate 🏠

- Materials ⚙️

The index composition is dynamic and undergoes rebalancing at least quarterly, in March, June, September, and December. Entry into the S&P 500 requires meeting strict criteria, including:

- Monthly trading volume exceeding 250,000 shares over the six months before evaluation 📈

- A minimum annual traded volume to market capitalization ratio of 1 ⚖️

- Company must be U.S.-based 🇺🇸

- Inclusion eligibility for regular public companies and REITs listed on U.S. exchanges 🏛️

- Market capitalization of at least $4.1 billion 💵

- Balanced weighting to avoid over-concentration in any single sector ⚖️

- No restrictions on recently completed IPOs since April 2019 🚀

Top 10 Companies by Market Capitalization in the S&P 500 📊

| № | Name | Ticker | Market Capitalization | Share in Index (%) |

|---|---|---|---|---|

| 1 | Apple Inc. | AAPL | $3.37T | 6.61 |

| 2 | Microsoft Corp | MSFT | $3.88T | 5.58 |

| 3 | Amazon.com Inc. | AMZN | $2.36T | 2.51 |

| 4 | NVIDIA Corp | NVDA | $4.44T | 1.73 |

| 5 | Tesla Inc. | TSLA | $1.09T | 1.66 |

| 6 | Berkshire Hathaway Inc. | BRK.B | $1.00T | 1.65 |

| 7 | Alphabet Inc. Class A | GOOGL | $2.43T | 1.61 |

| 8 | Alphabet Inc. Class C | GOOG | $2.43T | 1.43 |

| 9 | Exxon Mobil Corp | XOM | $451.18B | 1.36 |

| 10 | UnitedHealth Group Inc. | UNH | $228.93B | 1.33 |

The volatility of the S&P 500 index has historically remained at an average level ⚖️. Over the past 20 years, daily volatility exceeded 100 points only a few times 📉📈. Most of the time, it ranged between 20-50 points ⚡, reflecting relatively stable market conditions.

The record-breaking volatility occurred in March 2020 🦠🌍, when global stock markets plunged due to the COVID-19 pandemic. On that day, the S&P 500 index experienced volatility of over 300 points 🚨, highlighting extreme market uncertainty and turbulence.

Calculation of the S&P 500 Index

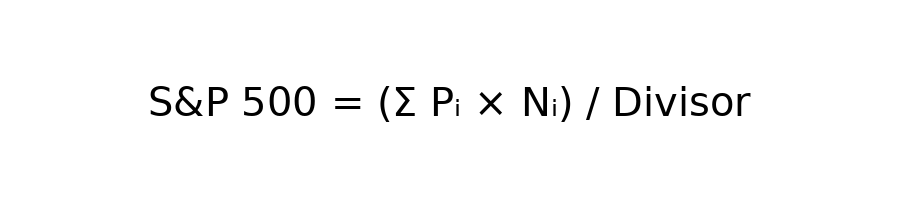

As for the calculation, a standard formula is used to “weight” companies by capitalization:

- For each company, the product of the share price and the number of securities in free access (free float – those securities that can be bought on the stock exchange) is calculated;

- The results are summed up and the resulting number is divided by Divisor – a coefficient selected during the development of the index.

The index value is calculated using the formula:

Where:

- n = 500 — number of companies in the index;

- Pi — price of the i-th company’s share;

- Ni — number of shares in free circulation for the i-th company;

- Divisor — synthetic scaling coefficient used to maintain index continuity.

The S&P Index Family — Beyond the Famous 500

While the S&P 500 steals most of the spotlight, the S&P family is actually a vast ecosystem of indices covering different regions, company sizes, and market segments. Here are some of the most notable ones:

- S&P MidCap 400 – Tracks 400 American companies with medium market capitalization.

- S&P SmallCap 600 – Focuses on 600 smaller U.S. companies with lower market capitalization.

- S&P 1500 – A composite index uniting the S&P 500, S&P MidCap 400, and S&P SmallCap 600.

- S&P 100 – A premium slice of the S&P 500, featuring 100 of the most influential and established U.S. corporations.

- S&P Total Return – Measures total performance by factoring in dividends from S&P 500 companies.

- S&P Europe 350 – Tracks 350 leading companies from across Europe.

- S&P/ASX 50 – A benchmark for the Australian stock market, featuring 50 top firms.

- S&P Asia 50 – Covers companies listed in Hong Kong, South Korea, Singapore, and Taiwan.

- S&P Latin America 40 – Includes 40 top companies from Brazil, Chile, Colombia, Mexico, and Peru.

- S&P/TOPIX 150 – A major regional index representing the Japanese stock market.

- S&P/TSX 60 – Lists 60 of the largest companies traded on the Toronto Stock Exchange.

- S&P Global 1200 – A truly global benchmark, combining 1,200 companies from 31 countries, including the S&P 500 and six key regional indices above.

In addition to global and regional indices, the S&P family also includes industry-specific and criteria-based varieties — over 100 indices in total. These allow investors to analyze markets globally while still focusing on specific sectors, regions, or company sizes — making the S&P family a vital toolkit for both traders and long-term investors.

Investing in the S&P 500 via ETF Funds

Exchange-Traded Funds, or ETFs, offer a simple way to invest in a broad market index like the S&P 500. These funds purchase shares of all companies in the index according to their specific weights, effectively mirroring the index’s performance. By buying a single ETF share, you gain exposure to an entire basket of stocks, diversifying your investment instantly.

Imagine trying to purchase individual shares from the 500 companies in the S&P 500 on your own — the cost would quickly add up to tens of thousands of dollars, and managing such a portfolio would be complex. In contrast, an ETF share usually costs between $50 and $250, providing an affordable way to track the index’s overall returns without the hassle of buying each stock separately.

One of the most popular ETFs tracking this benchmark is the SPDR S&P 500 ETF Trust (SPY). Launched on January 22, 1993, and managed by State Street Global Advisors, SPY offers highly accurate replication of the S&P 500 index. It operates as a Unit Investment Trust (UIT) and currently manages assets exceeding $300 billion.

Choosing an ETF like SPY allows investors to participate in the growth of America’s largest companies with the convenience and liquidity of trading a single security on the stock exchange.

iShares Core S&P 500 (IVV) has been available since 2000 and closely mirrors SPY in its approach, with BlackRock as its issuer. It offers investors a reliable way to track the S&P 500 index with low costs and high liquidity.

Vanguard S&P 500 (VOO) is a newer fund, launched in 2010 by Vanguard. Like IVV and SPY, VOO tracks the S&P 500 with great precision, making it a popular choice for long-term investors seeking cost-effective index exposure.

ProShares Trust PSHS Ult S&P 500 (SSO) is a leveraged ETF that amplifies the index’s movements by two times. For example, if the S&P 500 rises by 2%, SSO’s shares could increase by 4%. However, losses are also magnified, making it suitable only for experienced investors comfortable with higher risk. The fund is managed by ProShares.

Additionally, inverse ETFs provide a way to profit from or hedge against market declines. These funds increase in value when the S&P 500 falls. Notable examples include ProShares Short S&P 500 (SH) and ProShares UltraShort S&P 500 (SDS). The latter uses leverage to magnify inverse returns. Both are issued by ProShares and are typically used for hedging or short-term strategies.

How to Make Money Trading S&P 500 Futures

Introduced in the early 1980s, S&P 500 futures have become a popular instrument for traders seeking more active engagement with the index compared to traditional ETFs. One of the key advantages of futures contracts is the use of leverage, which allows traders to control a larger position with a smaller amount of capital.

In addition to futures, S&P 500 options are actively traded on the Chicago Board Options Exchange (CBOE). These include options on the S&P 500 index itself as well as on ETF shares like SPDR S&P 500 (SPY). In total, CBOE offers five different types of options tied to the S&P 500, giving traders multiple strategies to profit or hedge risk.

The basic steps to start trading S&P 500 futures or options are straightforward:

- Open a trading account with a broker that provides access to futures and options platforms.

- Purchase a futures contract or an option based on the S&P 500 index.

- Decide whether to hold your position until contract expiration or engage in active intraday trading to capitalize on price fluctuations.

Beyond leverage and flexibility, another major benefit of trading futures is their exceptionally high liquidity. The CME reports that daily trading volume of S&P 500 futures is roughly eight times greater than the combined liquidity of major ETFs such as SPY, VOO, and IVV. This liquidity ensures tighter spreads and faster execution, key factors for active traders.

Key Features of Investing in S&P 500 ETNs

Exchange-Traded Notes (ETNs) are debt instruments traded on exchanges, similar in some ways to bonds. When you invest in an ETN, you are effectively lending money to the issuing company in exchange for a promise to pay a return linked to the performance of a specific index, such as the S&P 500.

Popular examples of S&P 500-related ETNs include iPath S&P 500 Dynamic VIX ETN (XVZ), iPath Series B S&P 500 VIX Mid-Term Futures (VXZ), and iPath Series B S&P 500 VIX Short-Term Futures (VXX). These ETNs are actively traded on exchanges like the Tel Aviv Stock Exchange (TASE).

The issuance and trading process of ETNs typically involves the following steps:

- The issuing company either sells ETNs directly to a dealer or lists them publicly on an exchange.

- Investors purchase these notes much like they would bonds, essentially providing capital to the issuer.

- ETNs have a set maturity date, at which point investors receive a payment based on the current value of the underlying index, such as the S&P 500.

While ETNs offer unique investment opportunities, ETFs generally provide greater reliability due to the lower risk of issuer default. Although a company bankruptcy is rare, it’s a risk to consider when choosing between ETNs and ETFs. Additionally, ETNs often suffer from lower market liquidity, which may impact trading flexibility.

The S&P 500 remains the premier gauge of the U.S. economy and one of the world’s most liquid and widely followed indices. Given the vast scale of the American economy, demand for instruments linked to this index, including ETNs and ETFs, is expected to stay strong in the years ahead.

S&P 500 – Live Chart and Market Overview 📈🇺🇸

1. What is the S&P 500 Index?

The S&P 500 is a stock market index tracking 500 of the largest publicly traded companies in the United States, representing diverse sectors.

2. How is the S&P 500 calculated?

The index is weighted by market capitalization, meaning companies with higher market values have more influence on the overall index.

3. Where can I track S&P 500 performance?

You can monitor the S&P 500 on major stock exchanges, financial news websites, and real-time market platforms.

4. What factors influence S&P 500 movements?

Corporate earnings, economic data, interest rates, global events, and investor sentiment impact the index’s performance.

5. Which companies are included in the S&P 500?

The index includes top US companies from sectors like technology, healthcare, finance, consumer goods, and industrials, such as Apple, Microsoft, Amazon, and Johnson & Johnson.

6. Can I invest directly in the S&P 500?

You cannot buy the index directly, but you can invest through index funds, ETFs, or derivatives that replicate the S&P 500.

7. How often is the S&P 500 updated?

The S&P 500 is updated in real-time during US market hours, reflecting the latest trading data of its component companies.

8. How does the US economy affect the S&P 500?

Strong GDP growth, low unemployment, and high corporate profits generally support upward trends in the S&P 500.

9. What role do interest rates play?

Higher interest rates can slow economic growth and negatively affect stock prices, while lower rates may boost investor confidence and the index.

10. How do global events impact the S&P 500?

Trade tensions, geopolitical conflicts, or global crises can create volatility and affect the performance of the S&P 500.

11. How can technical analysis be used on the S&P 500?

Traders use charts, moving averages, support/resistance levels, and indicators to predict index trends and price movements.

12. How do dividends influence the S&P 500?

Dividends paid by S&P 500 companies contribute to total returns for investors holding index funds or ETFs tracking the index.

13. Can the S&P 500 predict market trends?

While the index reflects the health of large US companies, it should be analyzed alongside other indices and economic indicators for accurate trend forecasting.

14. Are all sectors equally represented?

No, some sectors like technology or healthcare have higher market capitalization and therefore more influence on the S&P 500.

15. Where can I find reliable S&P 500 news?

Financial news platforms, stock exchange updates, and market analytics portals provide accurate and timely information about the S&P 500.

Market Update: S&P 500 Bullish Momentum Continues

“The prevailing bullish trend remains the primary focus as the upward momentum has yet to reach exhaustion. However, current wave structures present a notable technical nuance. Precisely identifying the termination point of medium-term Wave 1 (blue) remains challenging; the sub-wave structure suggests an initial diagonal, where the minor ‘Wave 3’ could potentially evolve into ‘Wave 5’.

Regardless of a potential deep correction, the overall bullish outlook remains intact. My immediate objective is the 7050 resistance zone. As always, prioritize disciplined risk management and execute trades only upon the confirmation of high-probability patterns.”

📈 Trading Plan for SPX500: Swing and Day Trading Strategy (OG Style)

📌 Market Bias

The current market trend for the SPX500 index is bullish, as confirmed by a 30-minute LSMA (Linear Smoothed Moving Average) pullback, signaling a potential resumption of the uptrend. Additionally, we are seeing confirmation from the 0.786 Fibonacci retracement level, which serves as a key support zone based on Fibonacci principles. This confluence of the MA and Fibonacci levels indicates a high probability of a bullish recovery.

📊 Entry Strategy (Thief Layering Strategy™)

Instead of executing a single large entry, my approach is to layer buy-limit orders to average into strength. The goal is to take advantage of price fluctuations and gradually build a position as the market moves in our favor. Here’s how I set it up:

Buy Limit: 6600

Buy Limit: 6620

Buy Limit: 6640

You can modify and extend these layers based on your trading strategy and risk management preferences. This approach allows you to enter the market more smoothly and reduces the impact of short-term price fluctuations.

🛑 Stop-Loss (SL)

My stop-loss is placed at 6560. However, it’s important to understand that this is not a one-size-fits-all recommendation. Every trader must assess risk based on their own strategy and market understanding. Protecting your capital should always be the top priority.

🎯 Target Price (TP)

My price target is set at 6750, a level that aligns with a strong resistance zone, as well as the overbought territory — a potential area for a bull trap. It’s important to note that taking profits should always be based on your trading plan. Don’t hesitate to lock in profits when the setup aligns with your objectives.

🔎 Key Related Assets to Monitor

To validate the SPX500’s movement, it’s critical to track correlated assets that influence the broader market:

NDX (Nasdaq 100): This index, heavily weighted with technology stocks, shows a strong correlation with SPX500. If the tech sector rallies, it provides a bullish signal for SPX500 trades.

DXY (US Dollar Index): A weakening dollar often supports equities. Watch for an inverse correlation — if DXY drops, it could signal a rally in SPX500.

VIX (Volatility Index): A low VIX level indicates market calm, which supports our bullish setup. A sudden spike in VIX would indicate potential volatility, so it’s crucial to remain cautious.

💡 Expert Correlation Insight

Technically, SPX500 and NDX tend to move in tandem, particularly due to the shared weight of tech giants like Apple, Microsoft, and others. If NDX is rallying, it provides a tailwind for SPX500. Conversely, rising DXY or VIX may signal market risks, prompting a more cautious approach.

📝 Important Disclaimer

This trading plan is a personal playbook for my swing and day trading approach and should not be construed as financial advice. Every trader is encouraged to do their own research and risk management. It’s crucial to enter and exit positions according to your own analysis of the market.

Final Thoughts

If you find value in this analysis, a 👍 and 🚀 boost is greatly appreciated. Your support helps me share more setups and strategies with the trading community!

Expert Terms & Concepts

Elliott Waves: The theory of impulse and corrective waves, used to forecast market movements across various timeframes.

Fibonacci Levels: The application of Fibonacci retracements and extensions to identify potential support and resistance levels.

MACD (Moving Average Convergence Divergence): A trend-following indicator used to identify changes in momentum, with signals generated by the crossing of moving averages.

RSI (Relative Strength Index): A momentum oscillator that measures overbought and oversold conditions in the market.

SPX500USD: Correction Complete, Bullish Continuation Likely

Last week, SPX500USD wrapped up its corrective phase (Flat) and started moving higher, just as we anticipated in the previous outlook.

Currently, the price action isn’t very impulsive. It appears we might be witnessing the formation of an ending diagonal pattern. This suggests that we could see a gradual upward movement in the coming week.

Next Week’s Outlook: We’re expecting slow upward progress as the market continues to build structure. It’s not about fast momentum, but rather a steady climb.

Target Levels:

TP1: 6500

TP2: 6600

TP3: 6700

Trade Idea: Look for a small pullback and a shift in order flow to a bullish stance on lower timeframes. Once that happens, you can look to enter long positions with confidence.

If you’re interested in diving deeper into FVG’s (Fair Value Gaps), liquidity sweeps, and Wave analysis, make sure to follow me for more insights.

Disclaimer: This post represents my personal viewpoint based on technical analysis and may not reflect the market’s actual move. Always ensure to trade according to your own strategy and risk management.

Remember: Don’t trade emotionally. Stick to your plan!